30+ Current 20 year mortgage rates

2 days ago30-Year Fixed Mortgage Interest Rates. Rates on a 15-year mortgage tend to be slightly less than a 30-year mortgage.

Benchmark Mortgage Rate Nearing An Unprecedented Mark

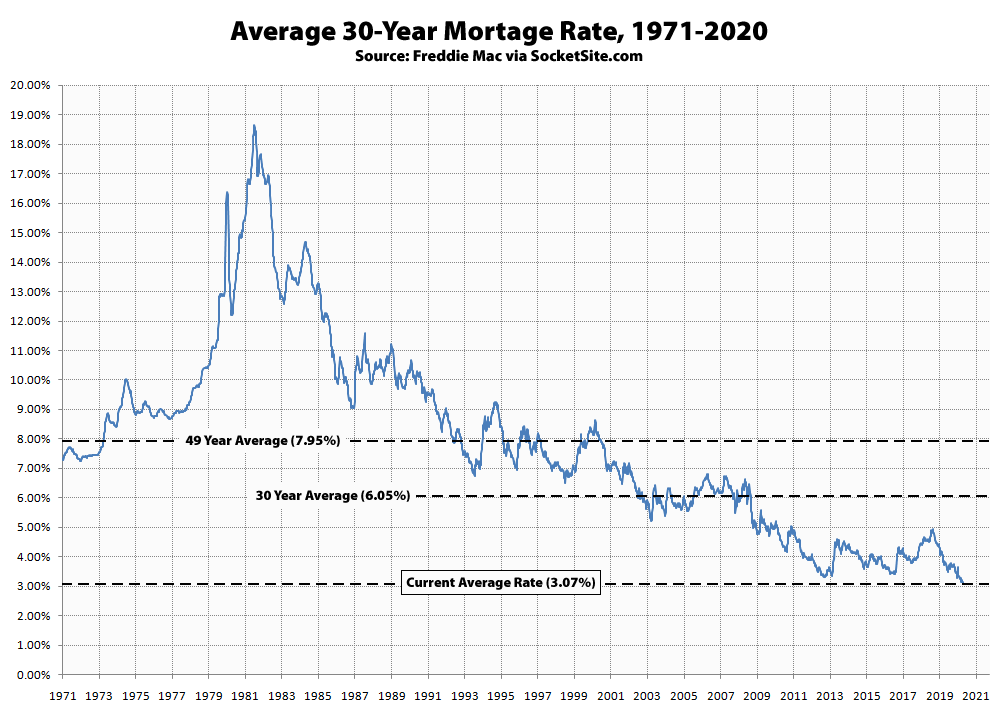

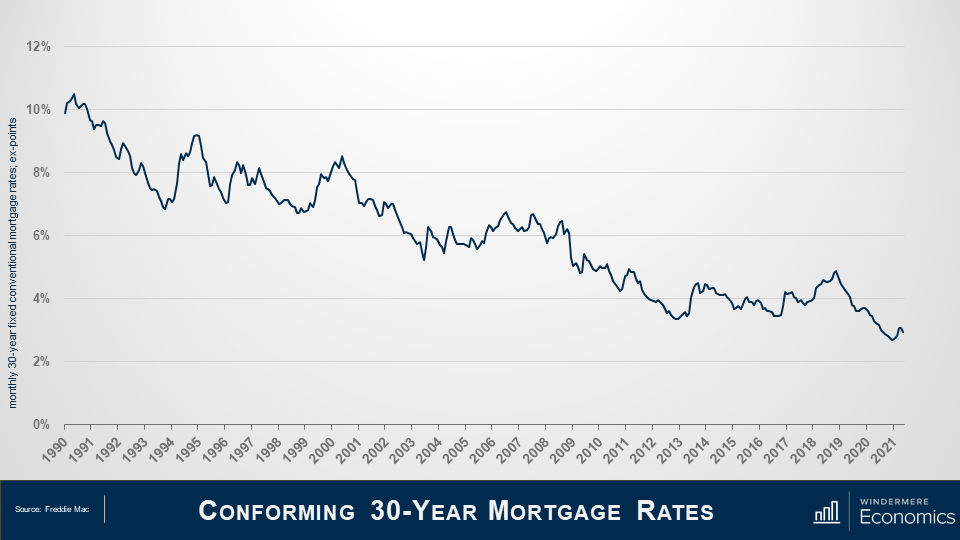

Historically 30-year mortgage rates have averaged.

. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason. Todays average fixed rate for a 15-year mortgage is 523 compared to the average of 512. View current mortgage rates for fixed-rate and adjustable-rate mortgages and get custom rates.

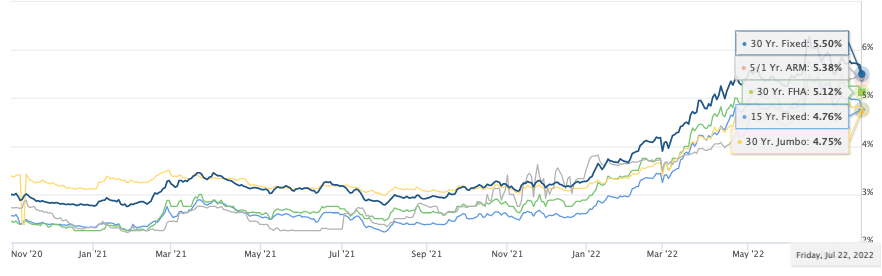

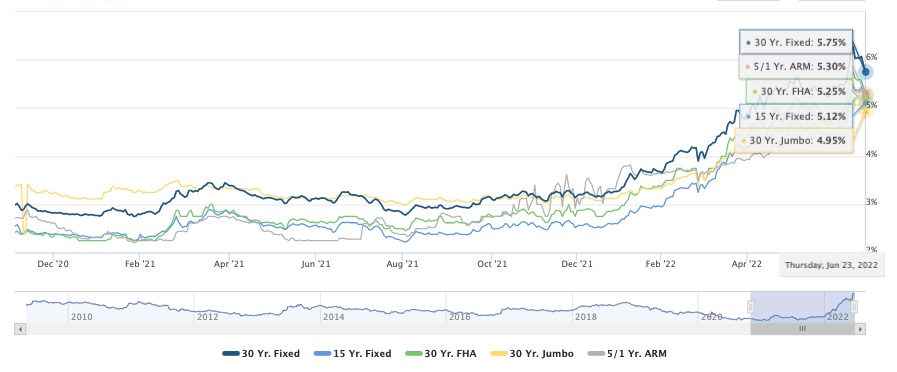

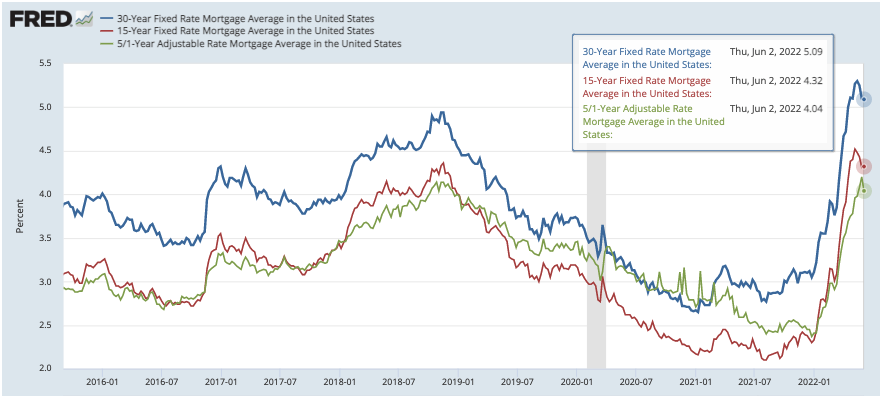

20-year fixed mortgage rates. The markets renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago. Is a 30-year fixed-rate mortgage right for you.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. For todays average see the tables above. For today September 2nd 2022 the current average mortgage rate for a 30-year fixed-rate mortgage is 5668 the average rate for a 15.

Current 20 Year Mortgage Rates. On Friday September 2nd 2022 the average APR on a 30-year fixed-rate mortgage fell 12 basis points to 5855. Thats a savings of 520 a month or.

30-year fixed mortgage rates. View daily mortgage and refinance interest rates for a variety of mortgage products and learn how we can help you reach your home financing goals. We adhere to strict standards of editorial integrity to help you make decisions with.

Compare 30-year mortgage rates from top lenders. 5625 down from. But a 20-year fixed rate mortgage for a home valued at 300000 with a 20 down payment and an interest rate of 300 the monthly payments would be about 1331 not including taxes.

Current 30-year mortgage rates. At 394 the monthly cost for a 200000 home loan was 948. 30-year fixed-rate refinance.

The average APR on a 15-year fixed-rate mortgage. Up from 5500 0250. On Thursday September 01 2022 the current average rate for the benchmark 30-year fixed mortgage is 595 rising 3 basis points over the last seven days.

The average mortgage rate went from 454 in 2018 to 394 in 2019. After a major rate dip last summer mortgage rates skyrocketed in the first half of 2022 with the 30-year average peaking in mid-June by an eye-popping 349 percentage points. The current average interest rate for a 30-year refinance is 589 an increase of 8 basis points from what we saw one week ago.

The median interest rate for a standard 30-year fixed mortgage is 608 which is a growth of 20 basis points from last week. This home loan has relatively low monthly. Based on data compiled by Credible three key mortgage rates for home purchases have risen and one remained unchanged since yesterday.

30 year jumbo refi rates 30 year jumbo rates 30. Best 20 year refinance rates 20 yr refinance rates today current 20 year interest rate 30 year fixed mortgage rates chart 20 year commercial. Average 30-year mortgage rates change daily sometimes more than once a day.

Current 30 Year Jumbo Mortgage Rates - If you are looking for options for lower your payments then we can provide you with solutions. Todays Mortgage Rates Today the average APR for the benchmark 30-year. Current 20 Year Refinance Rates - If you are looking for suitable options then our comfortable terms are just what you are looking for.

20 year commercial mortgage rates 20 year fixed. Terms may apply to offers listed on this page. Credible can help you compare current rates from multiple.

Current Mortgage and Refinance. 30-year fixed mortgage rates.

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

Home Loans St Louis Real Estate News

Home Loans St Louis Real Estate News

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

3

Do You Think All Homeowners Must Have A 20 Down Payment To Purchase A Home Luckily Mortgage Brokers Have S Real Estate Tips Back To Basics Home Ownership

1

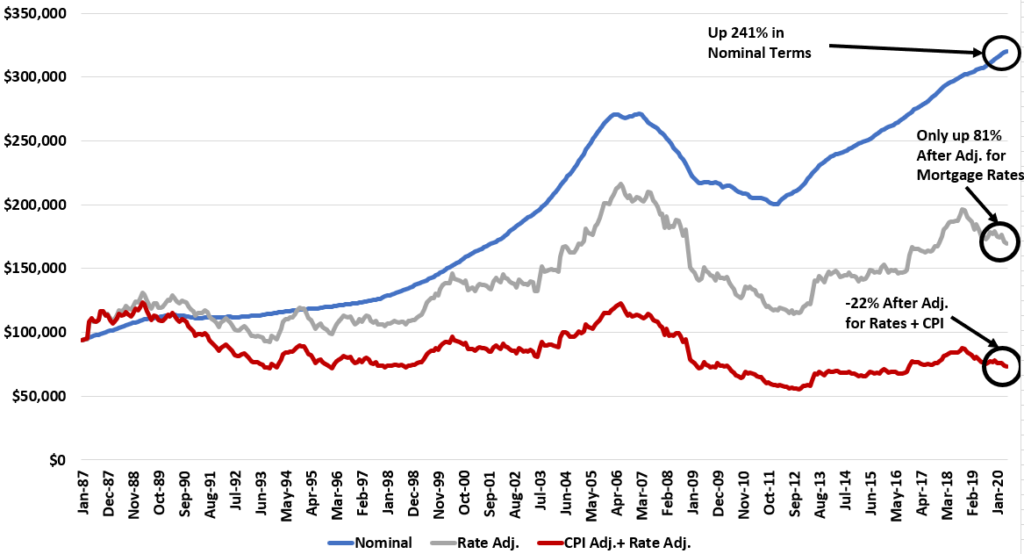

Mortgage Rates House Prices And Inflation Bounded Finance

Home Loans St Louis Real Estate News

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Home Loans St Louis Real Estate News

3

1

2

Home Loans St Louis Real Estate News

6 28 21 Housing And Economic Update From Matthew Gardner Windermere Real Estate

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs