22+ trid mortgage meaning

Web TRID is a consumer-protection law ensuring that homebuyers get important information in an easy-to-digest way. Contact Zachery Adam for more information about TRID.

What Is A Mortgage Types How They Work And Examples

Web 1 day agoEven 1 percentage point in interest can make a big difference over the course of a 30-year mortgage.

. Web TRID stands for TILA-RESPA Information Disclosure and is used in real estate to inform people who apply for a mortgage and describe loan lender rules. Web In real estate TRID is also known as Know Before You Owe as it was originally an initiative created to support more transparency and simplification when. Web 1 day ago30-year fixed-rate mortgages.

For the week ending March 16 it averaged 660 down from 673 the week before. Other home loans are more closely tethered to the Feds move. Think of it like a safety net to make sure youre not.

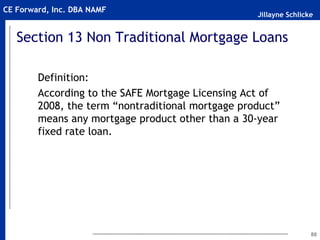

A year ago the. TRID is a new Rule which applies to most residential mortgage transactions that combines the Good. Only in the mortgage world would we make an acronym out of acronyms.

The rate on a 30-year fixed refinance decreased today. Web High-Cost Mortgage and Homeownership Counseling Amendments to the Truth in Lending Act Regulation Z and Homeownership Counseling Amendments to the. Web The TRID is an example of government agencies trying to make life easier for homebuyers.

Paying 6 rather than 7 on a conventional 500000 loan for. Web 1 day agoThe average rate for an identical loan was 42 percent the same week in 2022. Within three days of applying for a home purchase loan.

1 payments such as credits rebates and reimbursements that a creditor provides to a consumer to offset closing. Web 15 hours agoGetty. This rule is also known as the Know Before You Owe.

During this process borrowers must submit various types of financial information and documentation. Web What does TRID stand for. Web For purposes of the TRID Rule lender credits include.

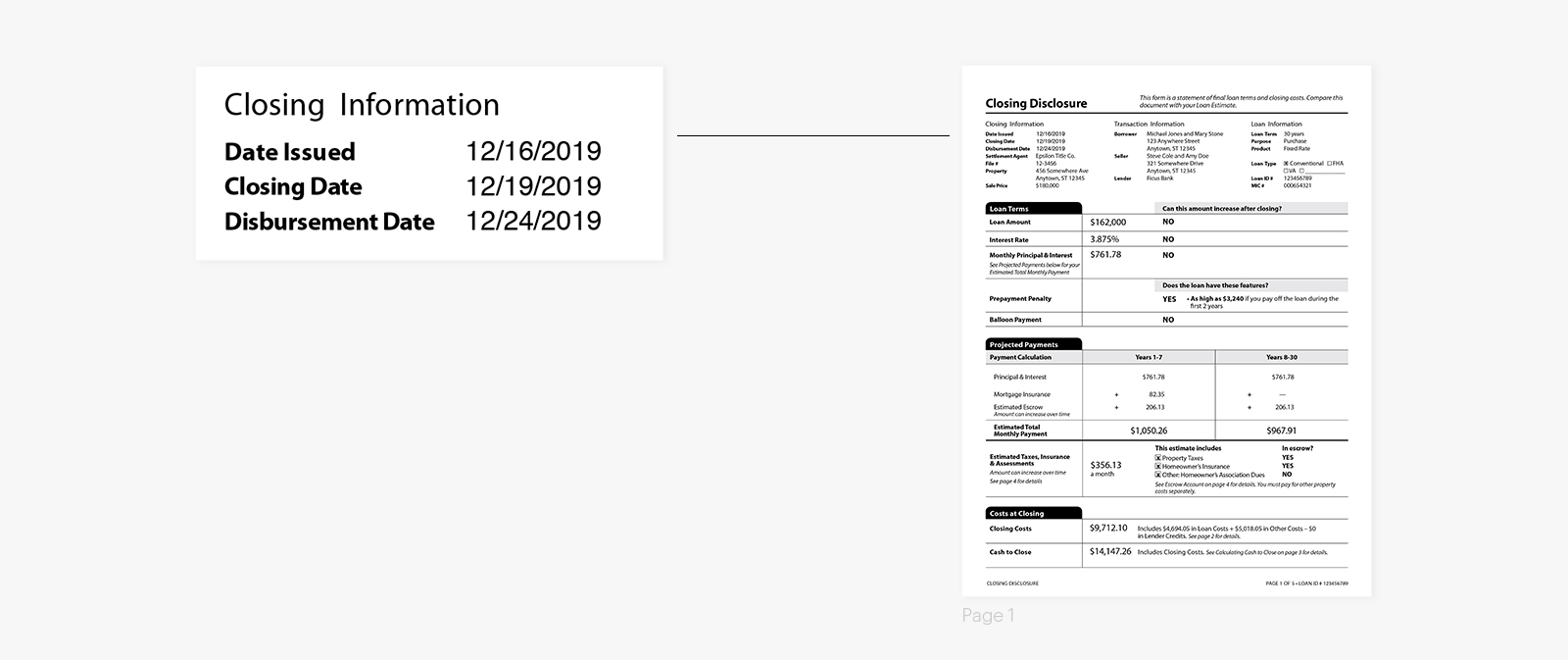

Web TRID requires consumers to receive two disclosures one at the beginning of a transaction and one at the end. The average rate for refinancing a 30-year fixed mortgage is currently 705 according to Bankrate. Web 1 day agoThe 30-year fixed rate mortgage has run north of 6 all year.

Web A mortgage loan is a loan in which property or real estate is used as collateral. For a 30-year fixed-rate mortgage the average rate youll pay is 694 which is a decline of 2 basis points as of seven days ago. TRID is the TILA RESPA Integrated Disclosure Rule.

Web TRID is an acronym that some people use to refer to the TILA RESPA Integrated Disclosure rule. Web TRID stands for TILA-RESPA Integrated Closing Disclosures.

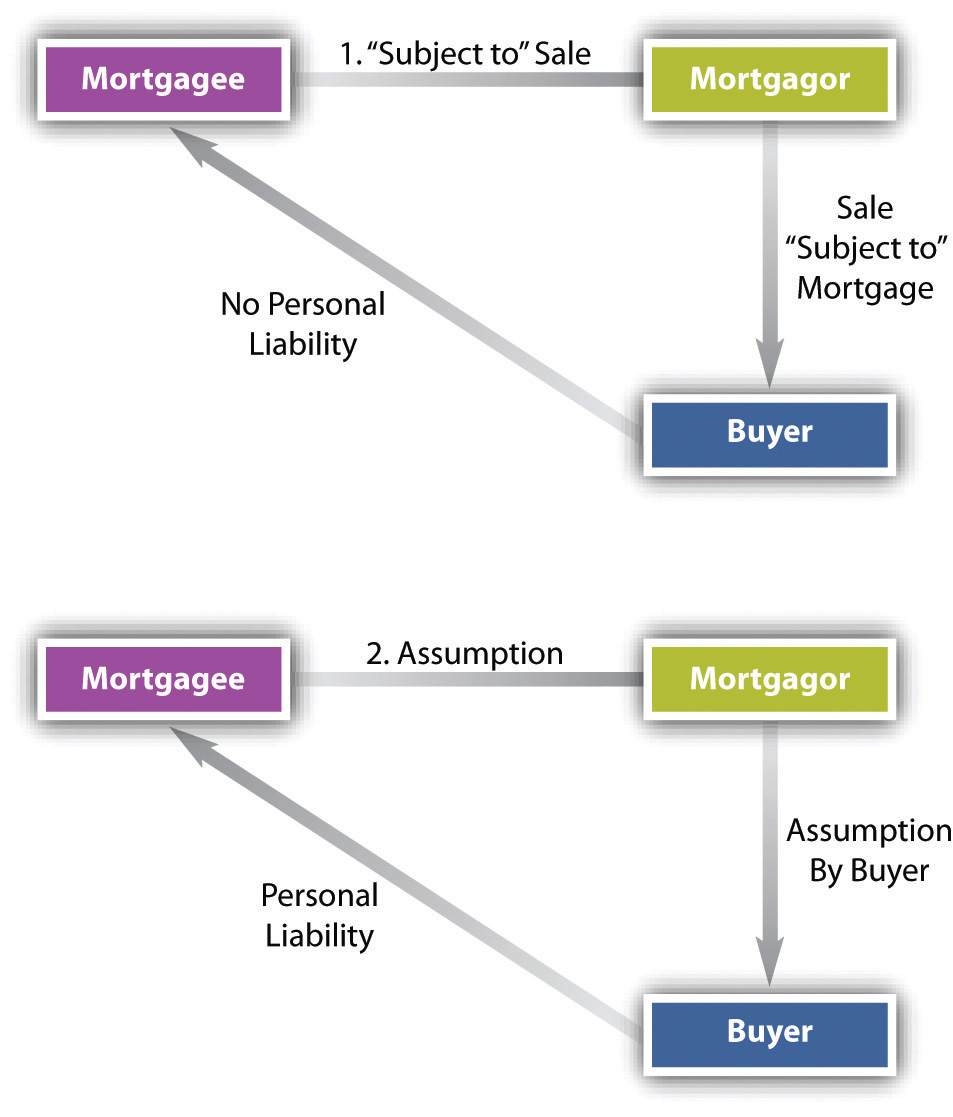

Priority Termination Of The Mortgage And Other Methods Of Using Real Estate As Security

Trid Good Faith Effect 2 0 Banker S Compliance Consulting

What Is Simple Mortgage Writinglaw

What Is Trid In Real Estate Bankrate

Safe Loan Originator Prelicensing And Exam Prep

5 Proven Ways To Make Mortgage Loan Processing More Efficient Time Bound

What Is Trid Definition Purpose Rules Video Lesson Transcript Study Com

Uniform Closing Dataset Freddie Mac Single Family

The Importance Of Trid When It Comes To Real Estate Closings

Loan Originator Pre Licensing And Exam Prep

Annual Percentage Rate Apr Formula Calculator

Understanding Trid And What It Means For The Mortgage Industry

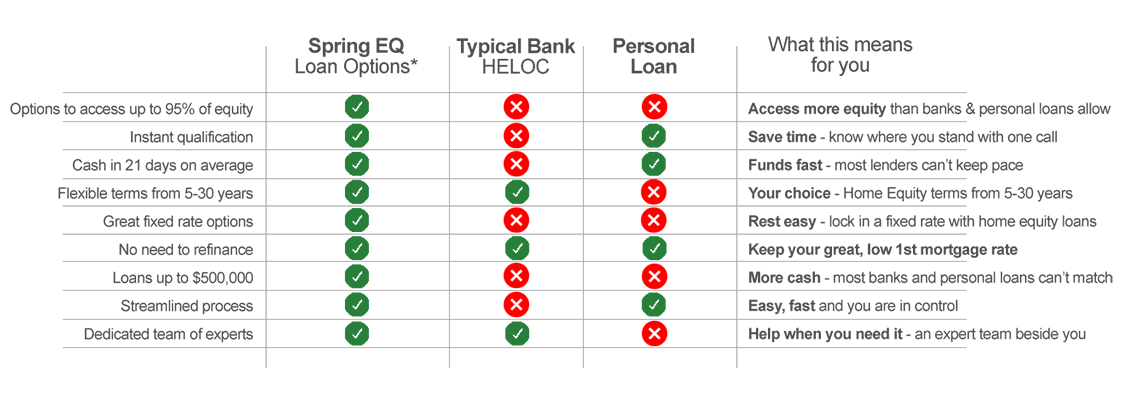

Spring Eq Home

:max_bytes(150000):strip_icc()/mortgage_contract-5c4254734cedfd0001ce1a99.jpg)

Conventional Mortgage Or Loan

Understanding Prepaids Impounds On Closing Disclosure Mortgage Blog

A Guide To Understanding Your Closing Disclosure Blumberg Blog

:max_bytes(150000):strip_icc()/dotdash-TheBalance-calculate-mortgage-315668-final-fd8c0ed392cd40118439cd1c23317e99.jpg)

Calculate Mortgage Payments Formula And Calculators